Athora Netherlands stimulates entities to prosper while operating within the planetary boundaries and respecting the social foundations of society. The investments of Athora Netherlands are managed for its own book by its own Investment Office and for the unit-linked investment fund portfolio by external asset managers, including Cardano. The sustainable investment policy of Athora Netherlands (and its brands) is identical to that of strategic partner Cardano.

We recognise that companies and countries that have prepared for this transition perform better than those that do not consider the changing material environmental, social and governance (ESG) requirements of society. Athora Netherlands' Sustainable Investment Policy stimulates companies and countries to prosper while operating within the planetary boundaries and respecting the social foundations of society. We call this the 'safe and just operating zone', where global challenges such as climate change, resource scarcity, social injustice and inequality are properly managed. The planetary boundaries and social foundations indicate the maximum amount of natural resources humanity can use without exhausting the planet and the minimum universal social and governance norms affecting people's health and wealth.

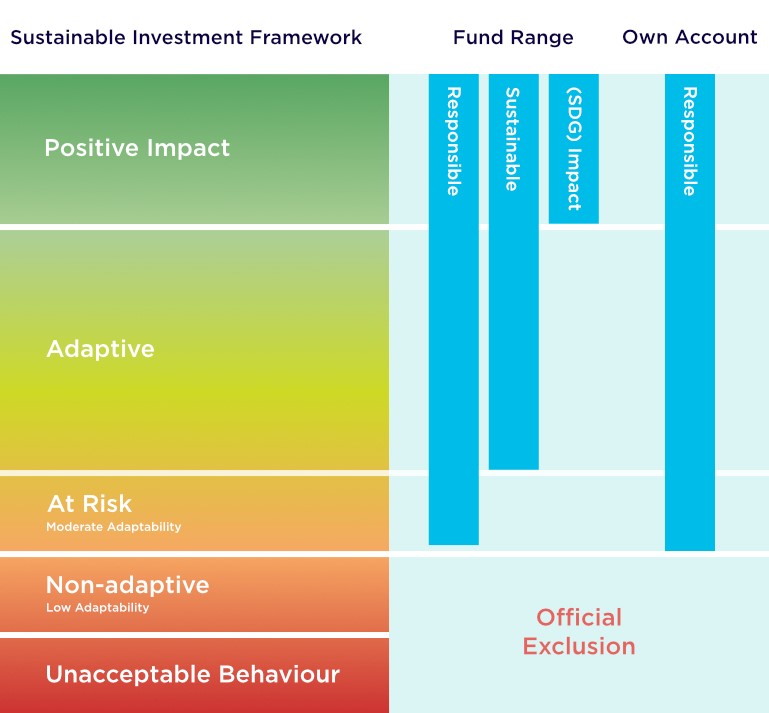

Based on the assessment of the Fundamental Investment Principles and the Material Sustainability Drivers, each company and country is categorised within the Athora Netherlands Sustainability Framework. The category determines the responsible investment instruments that apply to a company or country and the investment strategies and solutions in which an entity fits.

Sustainable Investment Framework

Positive Impact

Companies and countries taking the opportunities to make a positive and intentional contribution to the Sustainable Development Goals, while operating within the planetary boundaries. Through their positive contribution, the companies and countries expand the safe and just zone and are creating a positive impact. These companies and countries are allowed in our impact products.

Safe and Just Zone

This category contains companies and countries that properly manage the ongoing risks they are exposed to by the ongoing transitions, operate within the boundaries of the safe zone or on the required pathway towards the safe zone, but are not creating a positive impact. These companies and countries are allowed in our sustainable product solutions.

Transition Zone - Adaptive

Companies and countries (still) operating outside the boundaries, but already close to the required transition pathway, are considered to be adaptive. They have the adaptive capacity to prepare themselves for the material and operational risks that the transitions bring about. These companies and countries are allowed in our sustainable product solutions.

Transition Zone – At Risk

Companies and countries operating outside the boundaries, not operating on the required transition pathway and having unmanaged risks, are considered to be at risk. They currently lack the adaptive capacity to prepare themselves for the transitions and are vulnerable to operational risks. Yet, through active ownership, they may develop this capacity and reduce their risks. They are allowed in our responsible products.

Transition Zone – Non-adaptive

Companies and countries operating outside the boundaries, far removed from the required transition pathways, and lacking the capacity to bring risk management up to standards, are considered non-adaptive. They run serious operational risks in the short- to medium-term. These companies and countries are excluded from investments.

Unacceptable Behaviour Zone

Companies and countries not complying with the Fundamental Investment Principles are exhibiting unacceptable behaviour. These are excluded from the investment universe.