Through our investment policy, we seek to encourage companies and countries we invest in to prepare for the challenges facing global society. Parties that do not meet our minimum standards are excluded.

Fundamental Investment Principles

For Athora, investments must at least meet our sustainability criteria. Therefore we assess our investments in two steps. During the first step, we look at whether companies and countries meet our Fundamental Investment Principles. This is our ethical bottom line for which we pay attention to:

- Compliance with fundamental human rights

- Compliance with fundamental labour rights

- Involvement in controversial weapons and/or production and sale of civilian firearms and/or supply of military equipment to military regimes

- Compliance with international sanctions

- Systematic involvement in fraud, corruption and tax evasion

- Significant involvement in products or businesses that harm human (mental) health or animal welfare

- Systematic involvement in serious environmental damage

If a company or country does not sufficiently comply with our fundamental investment principles, we will not invest in it.

Sustainability Framework

For companies, we then apply a second step where we examine how a company performs on seven material sustainability indicators that we determine. These are:

- Fossil fuel use

- Water use

- Land use

- Management of (chemical) waste

- Organisational design and integrity

- Social capital management

- Management of human capital

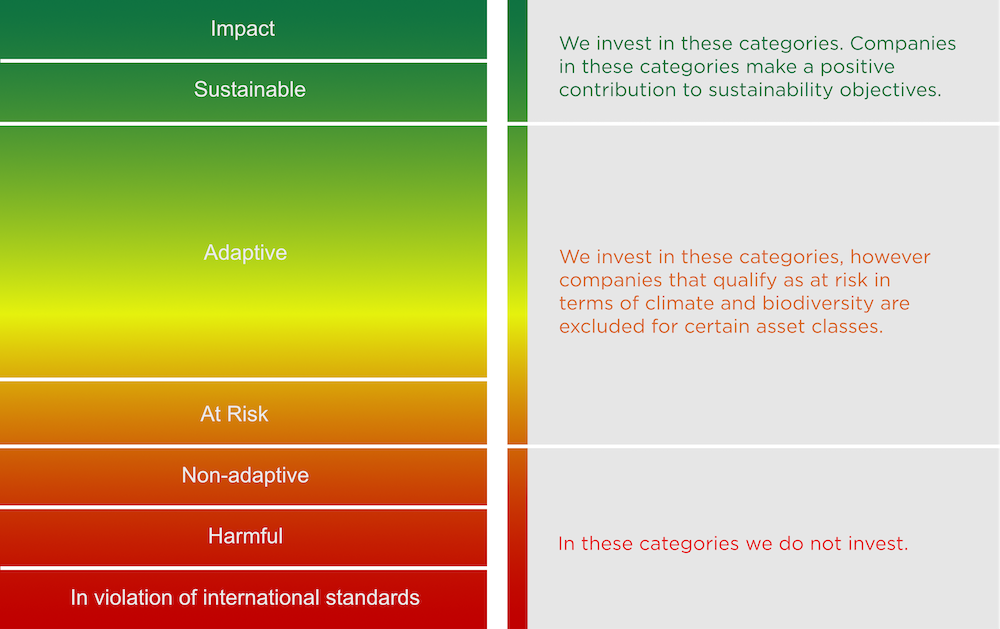

Which of the above sustainability indicators is most relevant depends on the sector in which the company operates. On the basis of the outcome of this survey, we determine the extent to which the company has sustainable operations and whether it makes a positive or negative contribution to certain sustainability goals in terms of climate, nature or people. This also determines where a company fits into our sustainability framework (see below). If a company does not yet have (fully) sustainable operations, we assess whether and to what extent it is capable of making the transition to this. Should this is not be the case or to a very limited extent, we will either exclude the company from investment or try to change its behaviour and policy for the better by engaging in targeted dialogue, either directly or through one of our engagement partners.