International Women's Day: an 'unlimited liveable' pension for all

8 March 2023 | 10:00

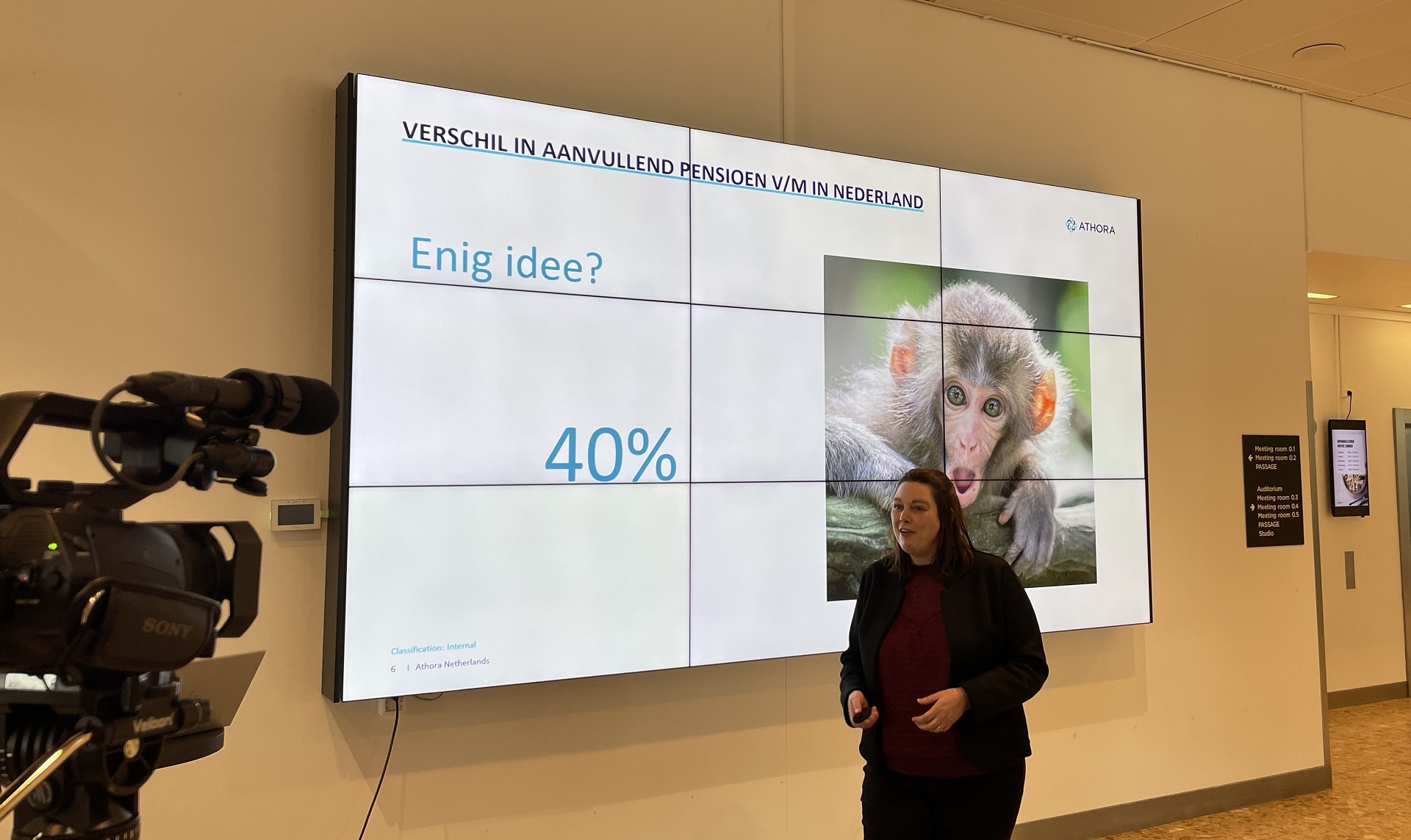

Today we at Athora Netherlands are marking International Women's Day, a day to call attention to inequality between men and women. These are present on many fronts - including in the area of Dutch pension provision. In fact, research shows that women accrue 40% less supplementary pension than men. "A shocking fact, which everyone should work on," says our colleague Marica Wismeijer, who has studied this subject.

Marica is reinsurance specialist and chair of the works council at Athora Netherlands as well as an active member of the Women's Network of trade union FNV. Today, at the invitation of Athora's newly formed Diversity Committee, she gave a presentation to colleagues about this relatively unknown problem. "I was shocked when I first heard about this huge pension gap of women compared to men," she says. "It's very important that we all pay more attention to this together, and this day is a good first step. Because 'unlimited liveable,' the theme of Women's Day 2023 in Holland, should also apply to financial security after retirement."

Text continues under the photo

Retirement gap

This large gap in retirement income between men and women is a potential source of poverty among women in later life and therefore a major problem. "I have always advocated equality, and financial dependence on your partner is not one of them. It turns out that although we are all covered by the same pension system in the Netherlands, we cannot use it in the same way."

Causes

To address a problem, you need to know what causes it. Marica delved into this social issue as a result of a webinar she attended on this a while ago from a British expert. She came across three main causes.

1) On average, women have shorter working lives than men. Biggest culprit here is the care gap: women account for most of the unpaid care. Social pressure on women to care for children at home is still high. And arrangements for childcare and parental leave encourage this inequality.

2) The wage gap: women still receive on average over 13% less pay than men for their paid work.

3) The organization of the pension system: in some industries - in which women are overrepresented - there is little to no employer pension accrual. Moreover, under the current system, you build up relatively most pension in the later part of working life, while it is precisely women who can make the greatest contribution at the beginning of their working life, when they do not yet have children. In the new pension system, this will improve somewhat with the new premium scheme, but this remains a concern.

Responsibility of all

It is a complex and comprehensive problem. That much is clear from Marica's research on the pension gap. The solution is therefore not simple, but it starts with awareness. "Everyone has a role to play in this. Not only women themselves, but also their partners, the government and pension providers like us. Everyone has a responsibility to contribute to raising awareness and ultimately closing this huge gap."

Kitchen table talks

Marica herself immediately surrendered her part-time day when she realized how much she was selling herself short. "It is important for everyone at the kitchen table to have good conversations about working more or less. It's fine if one of the two partners consciously chooses to work less, but at least make sure there's an extra retirement provision for each other. And if you start working more again, that might also be a time to put in some extra."

Solutions

There are many other possible solutions. As an employer, by alerting employees to the risk of the pension gap on a day like this. But also, as a pension provider by focusing on prevention, education and encouraging additional retirement savings when possible. "Creating transparency and awareness is a first step in solving this complex issue. After this day and on."

Read more about the pension gap?

Then read this paper from Netspar:

Equal rights, but not equal pensions: The gender gap in Dutch second pillar pensions - Netspar